VJ Tax Liens Certificate Investor, LLC established DEC. 2021. We specialized helping homeowners recoup overages from their foreclosures sales. We took the time to understand the state laws and know how to go about seeking their funds if there's any overages. Why would we allow the government to keep the overages, when it belongs to the homeowners?

**Definition of Unclaimed Money:**

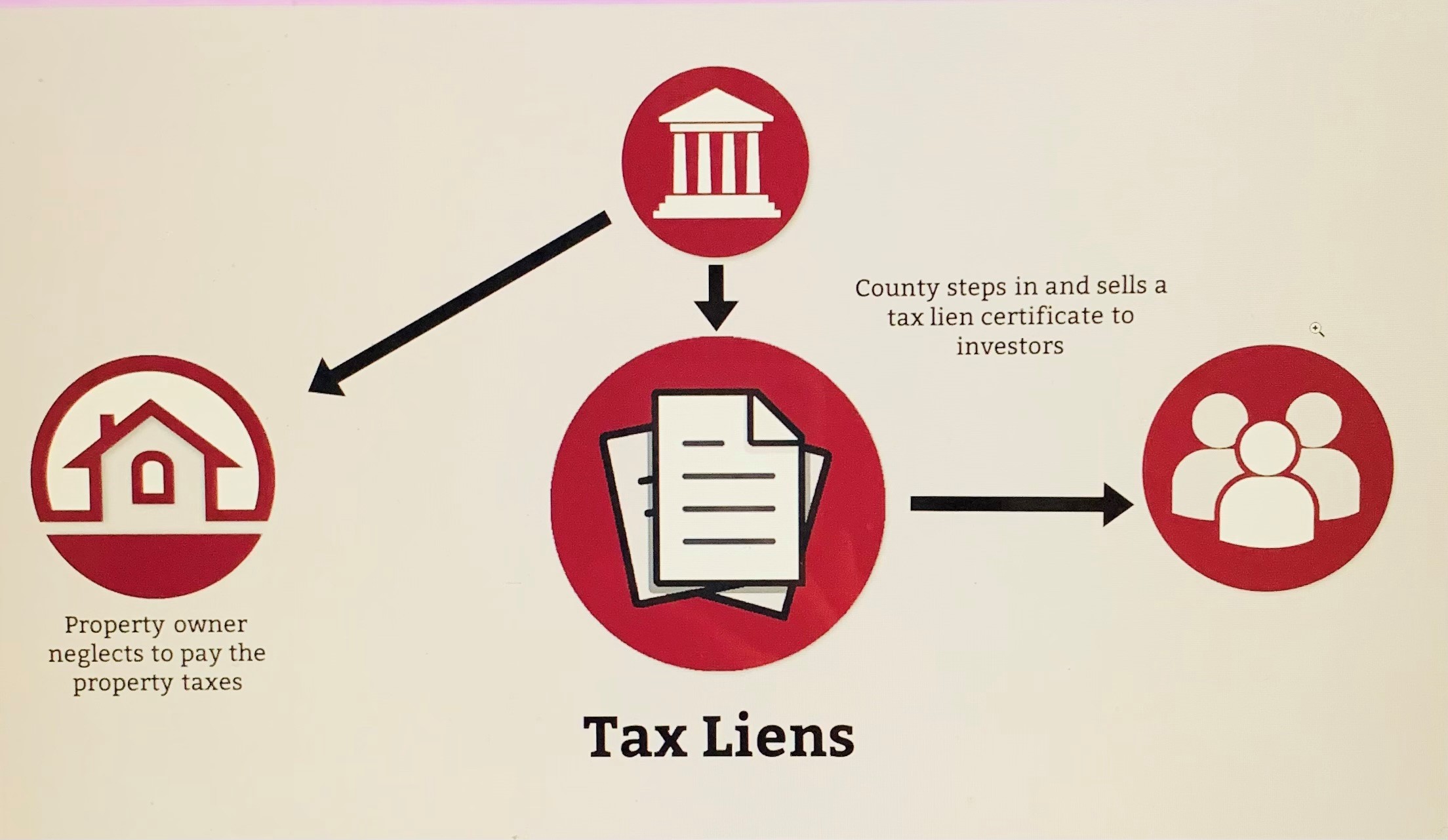

Unclaimed money refers to funds that have been generated from the sale

of properties through foreclosure, typically due to unpaid property taxes.

**Foreclosure Sales and Surplus Funds:**

In the event that

the property goes into foreclosure and is sold at auction, the proceeds from

the sale are used to cover the unpaid taxes and any associated fees. However,

if the sale generates more money than needed to cover these costs, the excess

funds are considered surplus. This is where we come in and collect those funds for you.

. **Distribution of Surplus Funds:**

Clarify that

surplus funds are not automatically distributed to the previous property owner.

Instead, they are typically held by the government or a relevant authority. The

process and regulations regarding the distribution of surplus funds can vary by

jurisdiction.